|

I might be impartial as this was the first major credit card I was approved for, but several years later and it’s still earning its place in my wallet - and handily punching above its weight, I might add. Before we start, let me dispel a rumor: Discover is worth your time and you'll be hard pressed to find a vendor in the United States where you cannot swipe it. I hope this article helps to convey my love for such a well performing card, and that you consider it as an addition to your wallet - whether your first card or your fifth.

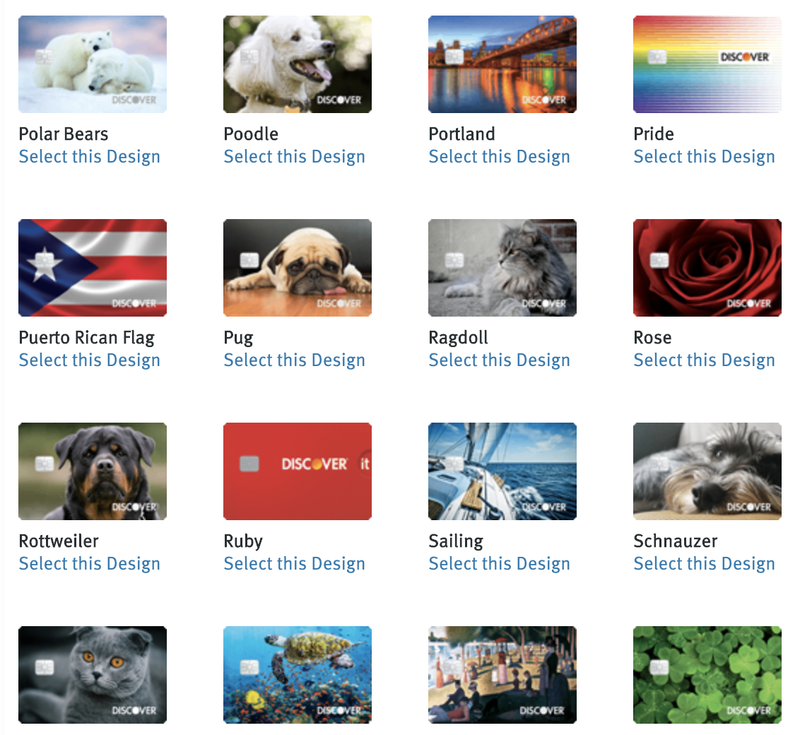

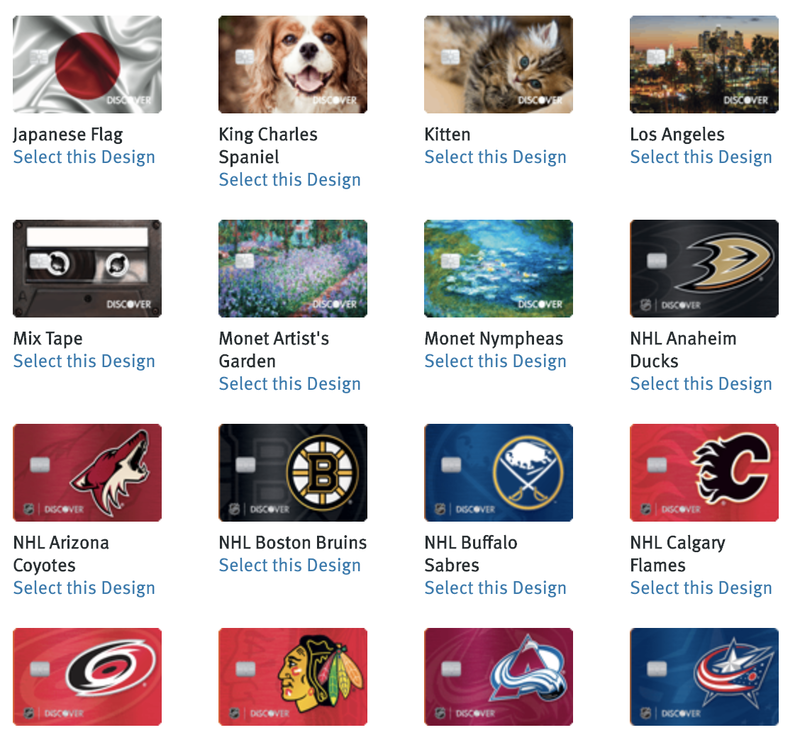

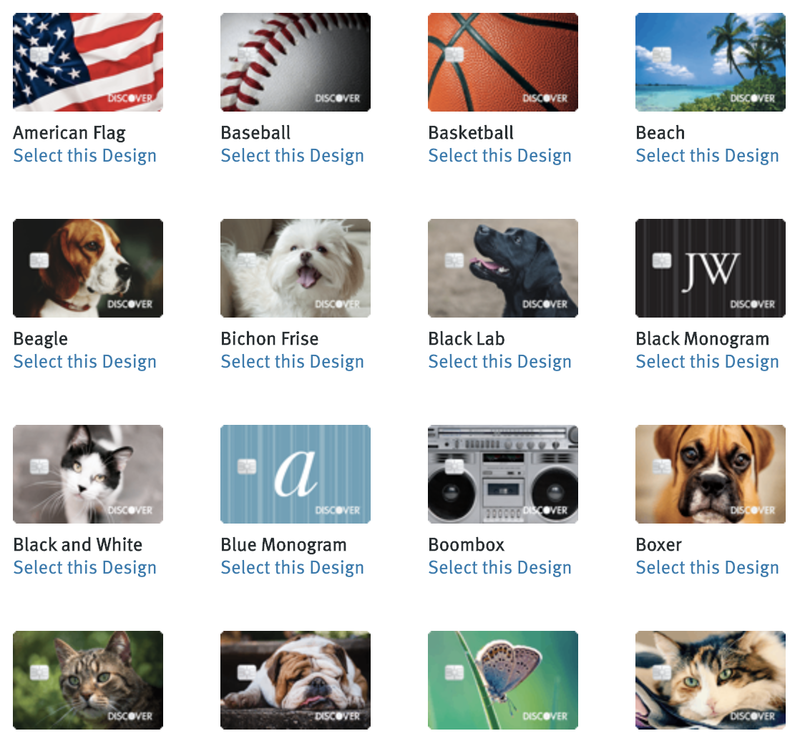

Widely Accepted The first reason that I love my Discover Card should really be a no-brainer for any credit card, but there’s a long standing rumor that Discover isn’t well received. While it’s true that the network is smaller outside of the US, I’ve not had a single instance where I wanted to use my It Card and could not; that being said, I would recommend a secondary card for travel abroad. No Annual Fee As you’ll see below, this card offers a great deal of value, and when comparing with some of its competitors, it’s shocking that it has a $0 Annual Fee. Not just in its first year, but forever, for the life of the card, for real! Generous Cash Back This card earns a very competitive 1% Cash Back on every purchase you make, which is a great start for understanding the value of credit. In addition, all of your cashback will be doubled at the end of your first year as a thank you for using your Discover Card. That means you'll earn at least 2% on all purchases in your first year - that's best in class! With the option to redeem points on Amazon or for statement credits, this can be really rewarding! Bonus Categories In addition to the 1% Cash Back category above, Discover also offers quarterly Bonus Categories that earn at an increased 5% Cash Back Rate! For example, at the time of writing, the current bonus is for Restaurants and PayPal purchases; around the holidays, online retailers like Amazon and Target are usually the focus. Customer Service If you’ve seen the commercials where the agent treats you, like you’d treat you, I’d tell you that it’s true! Discover has some of the friendliest customer service agents I’ve ever encountered. Whether by phone or online chat, they’re friendly, informative and efficient and I've never not had my issue resolved. Educational Tools One of the reasons I push this card so hard as a starter card, beyond the reasons listed above, is that it teaches you about credit and gives you a few breaks as you begin your journey. For example, you’ll get a monthly FICO Scorecard for free to track your progress and your first late payment has a waived fee to give you a warning. I think it was key in my development as a responsible card holder, and helps to hammer home the need to pay your card in full to maximize the value of your points and cashback earned. Card Designs This part is a little more fun, and far less technical, but Discover offers a TON of credit card designs so that you can pick the one that matches your style! When they announced the introduction of a rainbow card at Chicago Pride a number of years ago, I immediately ordered it, and still love the pizazz it adds to my wallet! Who is this card for?

If you can’t tell by now, this is a great credit card, especially for those just starting out! The lack of an annual fee, but presence of excellent award categories is a win win situation. Add in the superb customer service and the packaging just gets better. Still have questions? Drop us a line in the comments below! Ready to apply? Be sure to use the referral link in this article to claim your $50 Cashback Sign-Up Bonus (after you make your first purchase)!

0 Comments

Leave a Reply. |

RSS Feed

RSS Feed